How Much Money Do Banks Make On Overdraft Fees

Does Bank of America Offer Money Orders?

- Payment Options

- Alternative Ways To Get One

- How To Avoid Scams

- Bottom Line

Sundry Photography / Shutterstock.com

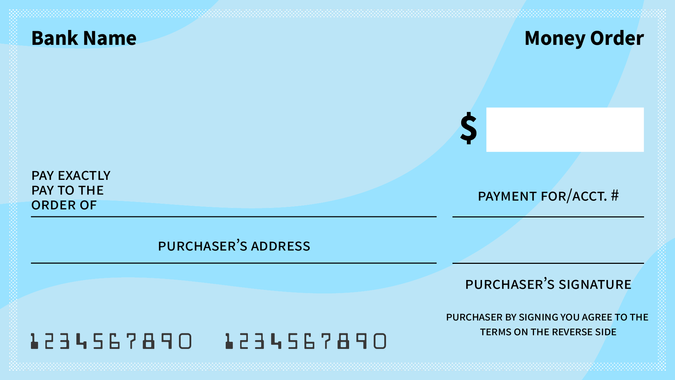

A money order is a paper document, much like a check, that is written for a specific amount and signed by the payer. Unlike a check, however, it's a guaranteed method of payment, which means that it's considered more secure.

Many banks sell money orders, and under certain circumstances, the fee may be waived. Unfortunately, Bank of America does not offer money orders. Find out about payment alternatives the bank offers and other places that offer money orders.

Can I Get a Money Order From Bank of America?

Bank of America does not offer money orders. However, if you have a Bank of America checking or savings account, you can get a cashier's check for $15. And if you're a Preferred Rewards member, cashier's checks are free.

Bank of America also offers other payment options to help you accomplish tasks like paying rent, such as Zelle, online bill pay and money transfers.

Alternative Ways To Get a Money Order

The cheapest place to get a money order will likely be at your bank, depending on the type of account you have. However, banks aren't always open when you need this form of payment. Take a look at money order fees at banks and other providers, so you'll know what to expect.

| Other Providers' Money Order Fees | |

| Provider | Fee |

| Walmart | $1 maximum fee; rates vary by location |

| U.S. Postal Service | $1.45-$1.95, depending on money order amount ($0.50 for postal military money orders) |

| Kroger | $0.84-$0.88, but fee may vary by state |

| Chase | $0 to $5 |

| U.S. Bank | $0 to $5 |

| TD Bank | $0 to $5 |

| Wells Fargo | $0 to $5 |

| Citibank | $0 to $5 |

Check Out Our Free Newsletters!

Every day, get fresh ideas on how to save and make money and achieve your financial goals.

How To Avoid Money Order Scams and Fraud

As with any form of payment, money orders are subject to scams and fraud. One of the most common scams is a buyer asking a seller to accept a money order for payment that's for more than what is owed. Then, the buyer asks the seller to deposit the money order and give back the difference. The seller might not realize the money order is fake until it's too late.

Here are some tips to be avoid falling victim to a money order scam.

Tips on Avoiding Money Order Fraud

- Make sure the money order is valid. Call the number on the money order and give the representative the serial number to verify that it's real.

- Examine the money order for signs that's it fake. Look for watermarks or other signs of authenticity. When in doubt, take the money to the issuer named on the document to have a representative verify whether the money order is real.

- Look for signs that the money order has been altered. Look at the amount the money order is for to see if the numbers in the amount payable look correct. If it looks as if the numbers have been altered — such as an extra zero added — do not accept the money order.

- Be leery of people who insist that you cash the money order immediately. If the money order is real, there's no reason why a person would insist that you cash it right away.

- Don't spend a money order deposit or issue a refund right away. You don't want to be on the hook for paying back the bank if the money order turns out to be fake.

Is Bank of America a Good Place To Get a Money Order?

Unfortunately, Bank of America does not offer money orders, but it does offer cashier's checks or other forms of payment, such as Zelle or money transfers. Additionally, you can visit retailers, the U.S. Postal Service or select banks that offer money orders. Some money order issuers will allow you to purchase the money order with a check, credit card or debit card, but call ahead to find out about any restrictions it may have, such as paying in cash.

Fees are subject to change. Information is accurate as of Nov. 12, 2021.

Cynthia Measom is a personal finance writer and editor with over 12 years of collective experience. Her articles have been featured in MSN, Aol, Yahoo Finance, INSIDER, Houston Chronicle, The Seattle Times and The Network Journal. She attended the University of Texas at Austin and earned a Bachelor of Arts degree in English.

Check Out Our Free Newsletters!

Every day, get fresh ideas on how to save and make money and achieve your financial goals.

How Much Money Do Banks Make On Overdraft Fees

Source: https://www.gobankingrates.com/banking/banks/what-bank-of-america-money-order-fee/

Posted by: williamsinne1963.blogspot.com

0 Response to "How Much Money Do Banks Make On Overdraft Fees"

Post a Comment